Regardless of what type of company you operate in Indonesia or company you operate globally, you will have to register for tax.

What is VAT?

Value-Added Tax (VAT) is a consumption tax applied to each of the product production stages all the way up until the product is up for sale.

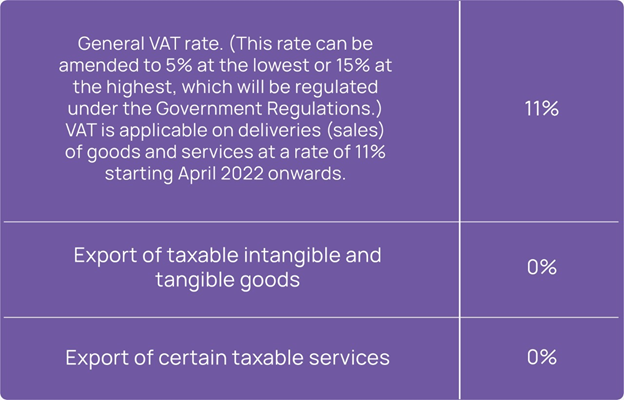

Vat Rates in Indonesia

Although most products and services in Indonesia are subjected to VAT, there are certain products that fall under the category of “non-taxable goods”. These include:

Non-Taxable Goods:

- Products from drilling or mining that are extracted from the source, such as natural gas, crude oil, coal, limestone, gemstone, phosphate, clay, and coal

- Food and drinks served in hotels and restaurants

- Gold bars, securities and cash

- Basic commodities such as salt, rice, soybeans, corn, sago, fresh meat, fruit, vegetables, tubers, and sugar

Non-Taxable Services:

- Medical and health services

- Mail services

- Labour services

- Financial services

- Broadcasting services that are not related to advertising

- Public telephone services

- Public transportation services

- Educational services

- Art and entertainment services

- Insurance services

- Religious services

- Social services such as funerals

What is Luxury Sales Goods Tax?

Luxury Sales Good tax is imposed on the delivery or importation of specific taxable luxury goods, such as luxury cars, apartments, or houses.

The LST rates are between 10% to 125% with a maximum of 200% allowed.