What is Withholding Tax?

Tax in Indonesia is based on a self-assessment system combined with a withholding tax regulation by the Indonesian government.

Income tax is collected through withholding taxes. The taxpayer must withhold and submit the correct legal taxes to the Indonesian tax offices on a monthly basis.

Withholding Tax Articles

Withholding Taxes are commonly referred to using the relevant article of the Income Tax (Pajak Penghasilan or PPh) Law, as follows:

Indonesia Tax Article 21

Under the income tax (Pajak Penghasilan – PPh) law, Article 21 states that all employers in Indonesia have to withhold tax from the salary and severance payments paid to employees, and pay the tax to the Indonesia State Treasury on the employee’s behalf.

Withholding tax article 21 on salary is final and the tax withheld can be claimed as a tax credit in the employee’s annual personal income tax return.

If you are a tax resident in Indonesia, without a taxpayer identification number (NPWP) you will be subjected to a higher tax rate of 20% from the normal tax rates.

Indonesia Tax Article 22

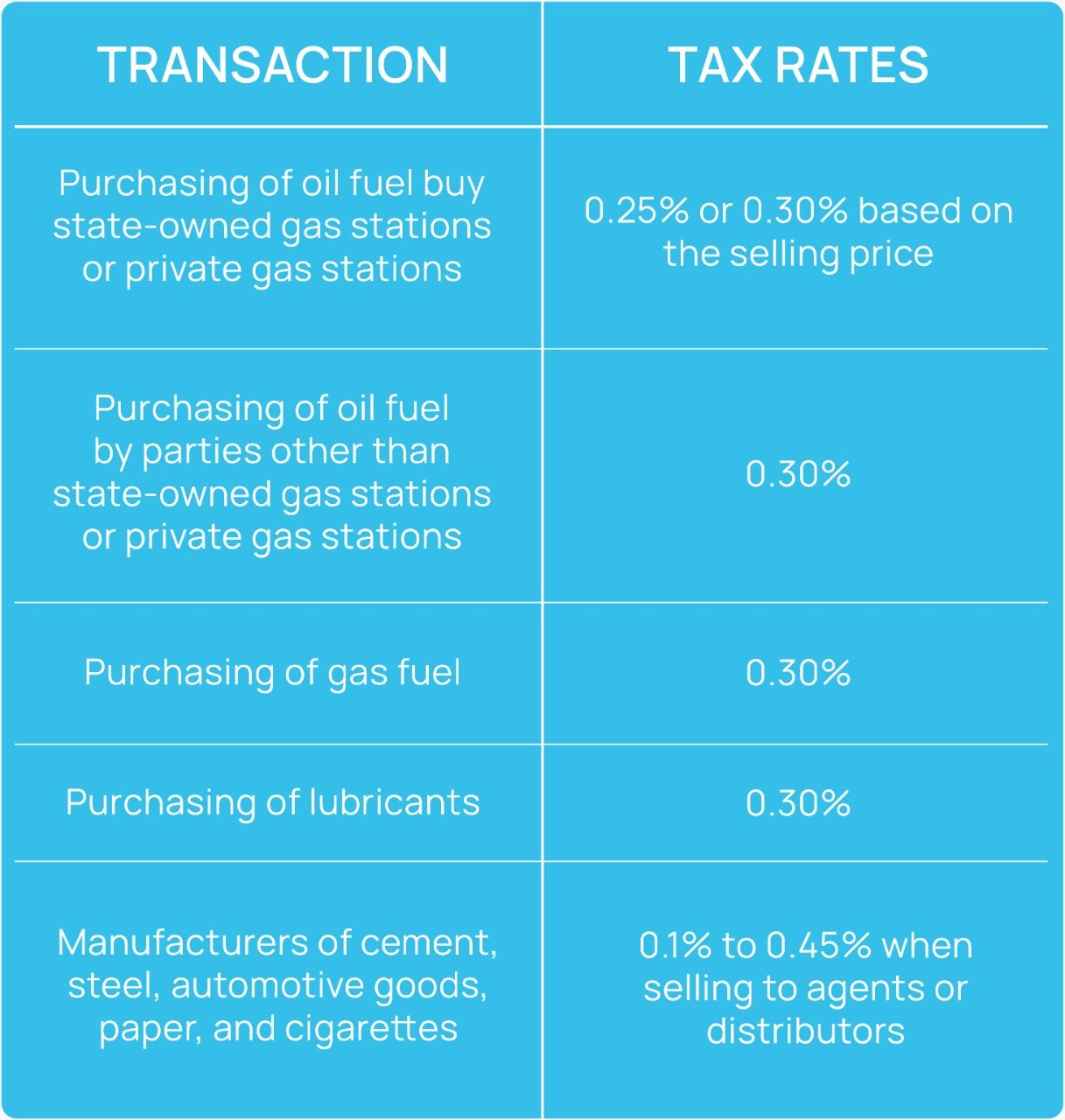

Withholding tax under Article 22 is for Indonesia based companies importing goods, receiving income from the State Treasurer/state-owned enterprises, buying certain specified products or purchasing extravagant luxury products.

The withholding tax rate on all of the above transactions includes:

Indonesia Tax Article 23

According to Article 23, specific types of income paid to tax residents in Indonesia are subject to withholding tax at a rate of either 2% or 15%.

Payments that are subject to 15% tax are:

- Dividends

- Interest

- Swap premiums

- Loan guarantee fees

- Royalties

- Prizes and awards

- Bonuses.

Indonesia Tax Article 26

Under article 26, Income received by a non-Indonesian taxpayer is subject to a rate of 20% final withholding tax.

Article 26 is applied to the following income:

- Dividends

- Interest

- Royalties

- Compensation

- Prizes and awards

- Swap premiums.

The tax rate can be reduced based on the applicable tax treaty if the non-resident taxpayer is a resident of the tax treaty partner country, subject to fulfilling certain requirements.

Indonesia Tax Article 4 (2)

Under article 4 paragraph 2, it states that transactions, that are subjected to final withholding tax include:

- Rental of land and buildings

- Transfer of land and building rights

- Construction services

- Additional tax on sale of Founder shares at IPO price

- Interest on time or savings deposits and on Bank Indonesia Certificates (SBI)

- Interest or discount on bonds

- Lottery prizes

- Dividends paid to individuals

Indonesia Tax Article 15

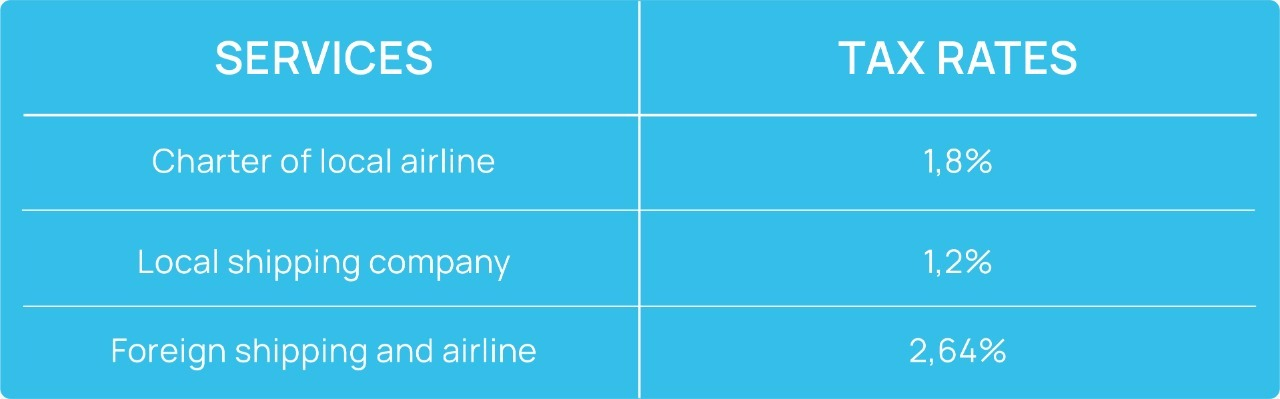

Transactions in relation with shipping and airline services provided by local and/or foreign companies are subject to article 15 withholding tax as per the tax rates below:

Are you ready to make your oversea’s tax planning stress free?

Our tax experts can help with all areas of tax planning in Bali, Indonesia.